coweta county property tax records

Clayton County Property Records are real estate documents that contain information related to real property in Clayton County Georgia. Tennessee is ranked 1062nd of the 3143 counties in the United States in order of the median amount of property taxes collected.

Joseph Pelletier Cad Engineering Manager Coweta County Water Authority Linkedin

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

. The Coweta County Sheriffs Office provides assistance on a call-for-service basis providing primary law enforcement services to all portions of the county not served by a municipal police department. Fresno County has one of the highest median property taxes in the United States and is ranked 658th of the 3143 counties in order of median property taxes. Grantville Haralson Moreland Newnan Palmetto Senoia Sharpsburg and Turin.

We would like to show you a description here but the site wont allow us. Contact the Personal Property Division of the Tax Assessors office at 770-254-2680 for specific information and filing requirements. Local state and federal government websites often end in gov.

NETR Online Richmond Richmond Public Records Search Richmond Records Richmond Property Tax Georgia Property Search Georgia Assessor. The median property tax in Sarasota County Florida is 2095 per year for a home worth the median value of 235100. 1100 AM - 1200 PM.

If you have an emergency dial 911. Clayton County Public Records. Census Bureau American Community Survey 2006-2010.

NETR Online Clayton Clayton Public Records Search Clayton Records Clayton Property Tax Georgia Property Search Georgia Assessor. Sarasota County has one of the highest median property taxes in the United States and is ranked 404th of the 3143 counties in order of. Indiana is ranked 890th of the 3143 counties in the United States in order of the median amount of property taxes collected.

The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300. Filing a property tax return homestead exemptions and appealing a property tax assessment. Inmate Accounts Lucy Howard 770-253-1664 ext.

Coweta County Public Records. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Thank you for visiting the Coweta County GA Website.

The Coweta County GA Website is not responsible for the content of external sites. Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

Coweta County Sheriffs Office Jail Division Major Eric Smith. From the Marvel Universe to DC Multiverse and Beyond we cover the greatest heroes in Print TV and Film. Fresno County collects on average 065 of a propertys assessed fair market value as property tax.

County Property Tax Facts. The Sheriffs Office Jail Division operates the Coweta County Jail - twenty-four hours a day seven days a week. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

For more localized statistics you can find your county in the Maryland property tax map or county list found on this page. Franklin County collects on average 167 of a propertys assessed fair market value as property tax. 2774 11th of 50 319 19th of 50 087 25th of 50.

This section provides information on property taxation in the various counties in Georgia. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Hamilton County collects on average 086 of a propertys assessed fair market value as property tax.

The Coweta County version of Freeport differs slightly from the state version. General Information Duties of the Clerk. The information provided is for tax purposes only and not legally binding.

You will be redirected to the destination page below in 3 seconds. Detention officers provide for inmate security. The median property tax in Marion County Indiana is 1408 per year for a home worth the median value of 122200.

During normal business hours Monday. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the 3143 counties in order of median. Franklin County has one of the highest median property taxes in the United States and is ranked 252nd of the 3143 counties in order of median property taxes.

The median property tax in Fresno County California is 1666 per year for a home worth the median value of 257000. Marion County collects on average 115 of a propertys assessed fair market value as property tax. NETR Online Coweta Coweta Public Records Search Coweta Records Coweta Property Tax Georgia Property Search Georgia Assessor.

Every effort has been made to include information based on the laws passed by the Georgia Assembly during the previous session. The goal of the Coweta County Tax Assessors office is to annually appraise at fair market value all tangible real and personal property located in Coweta County by utilizing uniform methods and. Information and Records Requests Office of the General Counsel Reports Publications.

Percentage Of Property Value. The information is as accurate and up to date information as possible. From the Marvel Universe to DC Multiverse and Beyond we cover the greatest heroes in Print TV and Film.

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. Coweta County Board of Commissioners -. Troup County Property Records are real estate documents that contain information related to real property in Troup County Georgia.

Coweta County Transit Meetings are held in the Commission Chambers located at 37 Perry Street second floor Newnan GA 30263. You can use the search below to find your county information. The gov means its official.

Sarasota County collects on average 089 of a propertys assessed fair market value as property tax. If you need non-emergency law enforcement service call the Sheriffs Office at 770 253-1502. Carroll County Property Records are real estate documents that contain information related to real property in Carroll County Georgia.

The median property tax in Hamilton County Tennessee is 1270 per year for a home worth the median value of 147200.

Geographic Information Systems Gis Coweta County Ga Website

Property Values Skyrocket But Taxes Haven T Been Set The Newnan Times Herald

Coweta County Georgia Public Records Directory

Coweta Transit Dial A Ride Coweta County Ga Website

Board Of Commissioners Coweta County Ga Website

Coweta Living 2017 2018 By The Times Herald Issuu

School Board Gives Initial Approval To Fy 2023 Budget The Newnan Times Herald

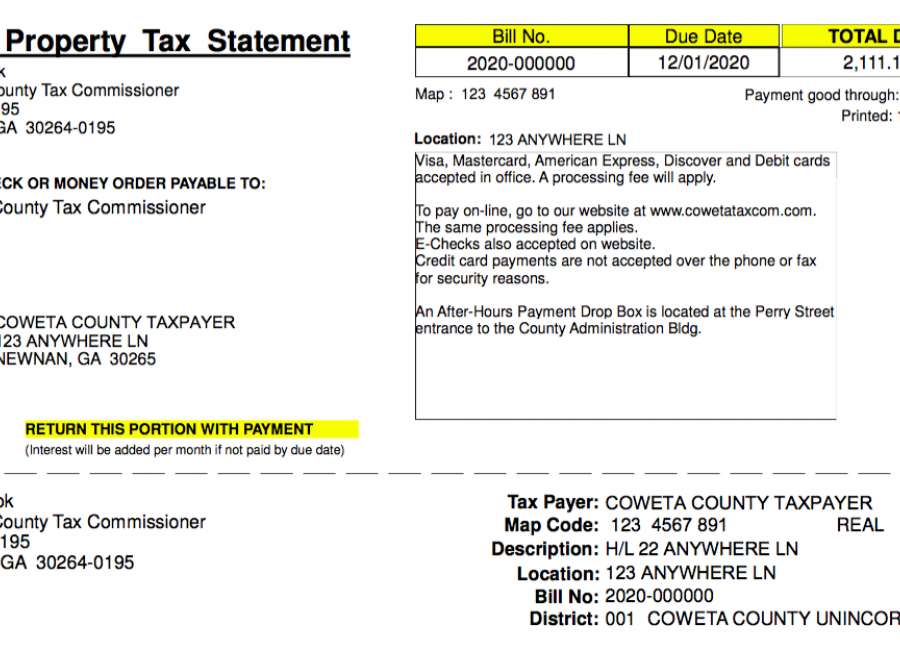

Property Tax Bills On Their Way The Newnan Times Herald

Event Services Coweta County Ga Website

Coweta Projects Property Tax Increase The Newnan Times Herald

Public Works Coweta County Ga Website

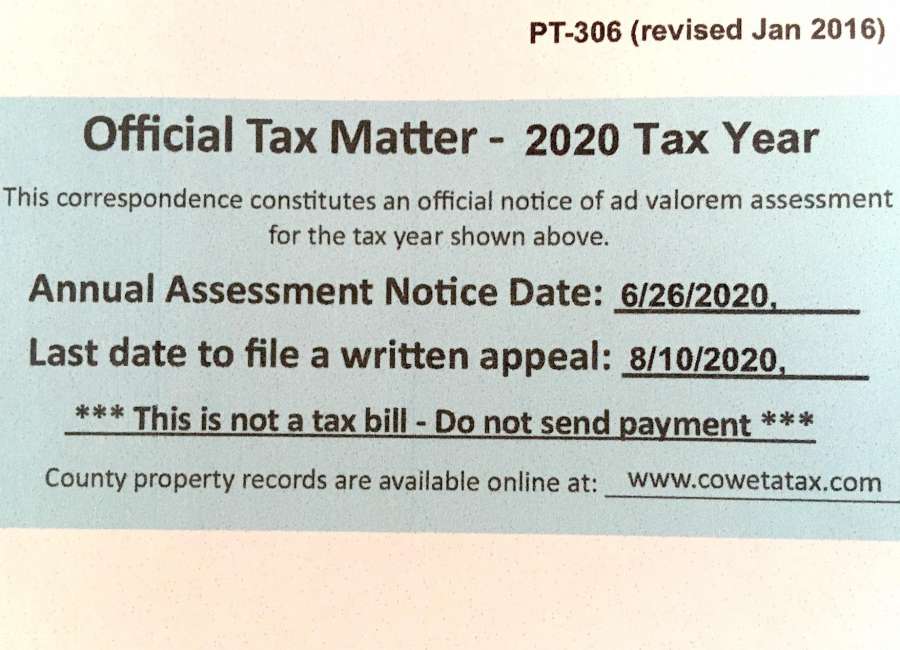

Coweta County Government 2020 Notices Of Assessment 2020 Notices Of Assessment Were Mailed On Friday June 26 2020 The 2020 Noa Is The Culmination Of A Three Year Revaluation Project For All